portfolio management

When pursuing alpha, speed matters.

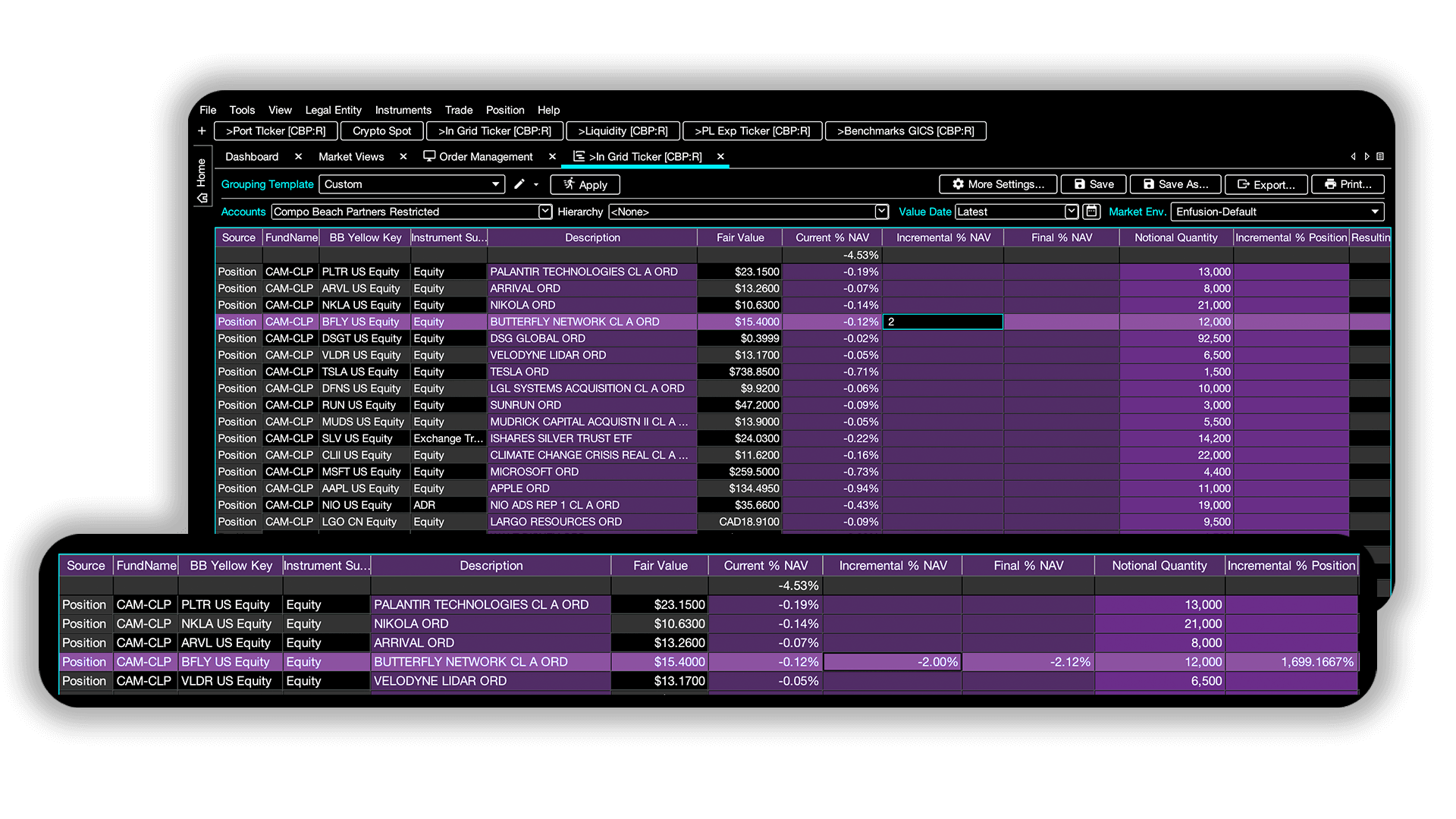

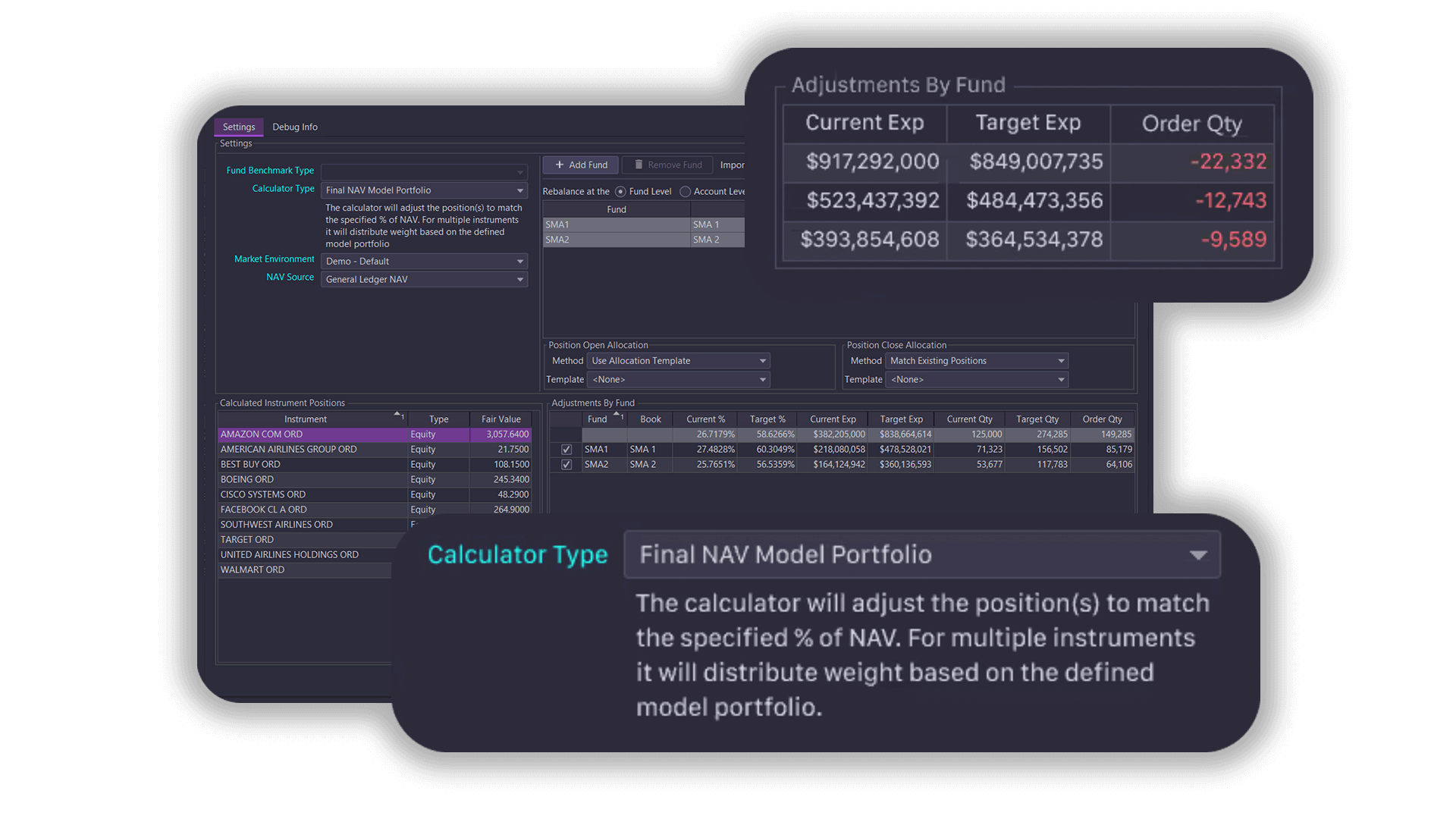

PORTFOLIO CONSTRUCTION

Nimbly respond to markets and generate alpha.

Download the brochures:

- Portfolio Monitoring brochure

- Portfolio Construction brochure

- Portfolio Valuation and Risk brochure

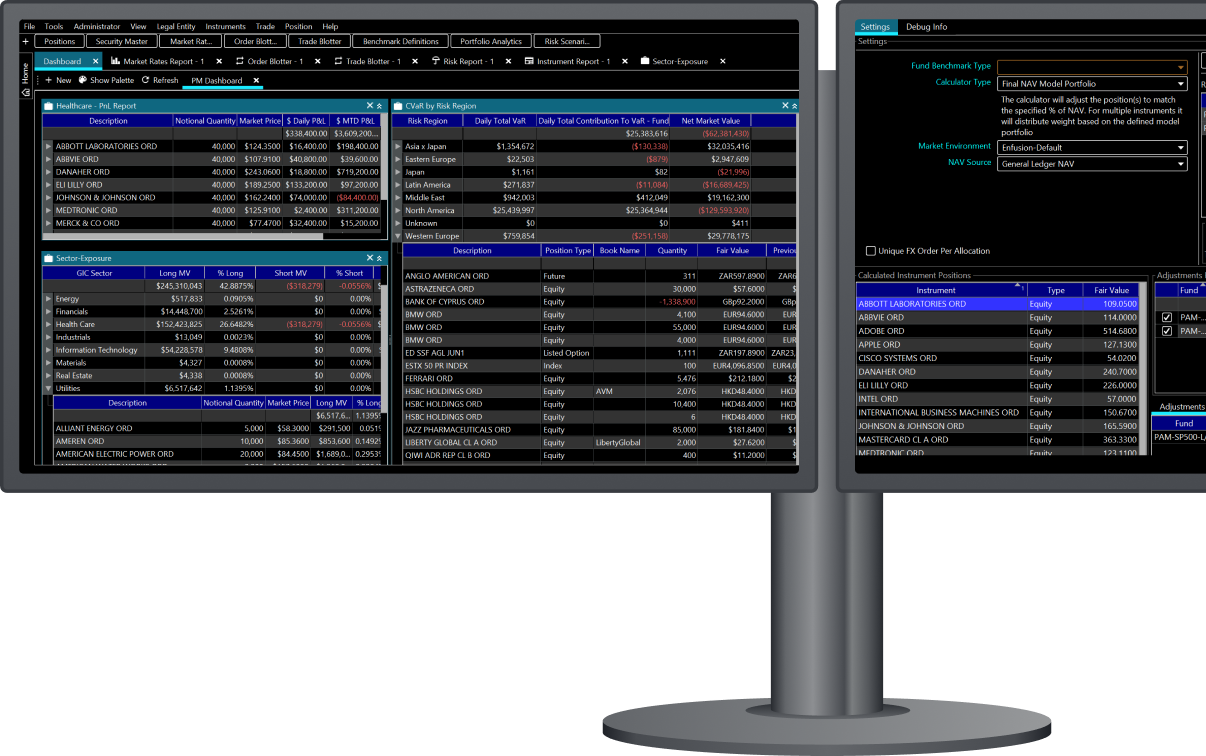

PRICING, VALUATION, AND RISK

Real-time analysis, without data scrubbing.

FRONT-TO-BACK PLATFORM

The wisest investment you’ll ever make.

Enfusion unlocks the full potential of your investment process across front, middle, and back office.

For CFOs and Accounting

Ensure faster time to launch, higher organizational efficiency, and a dramatic reduction in technical complexity—all of which reduces costs across your firm.

For Portfolio Managers

Enter new markets and deploy new strategies without disrupting your workflows with a multi-asset, integrated PMS/OEMS/analytics framework.

For Traders

Get the desktop, web and mobile tools you need to stage and execute even the most complex orders with total confidence: pre-trade compliance, customizable trade blotters, and more.

For COOs and Operational Leadership

Drive accuracy and transparency across your organization by allowing all teams to work from one synchronized dataset.