Compliance and Risk

Keeping the downside top of mind.

Share

Landscape

Control for every possible outcome.

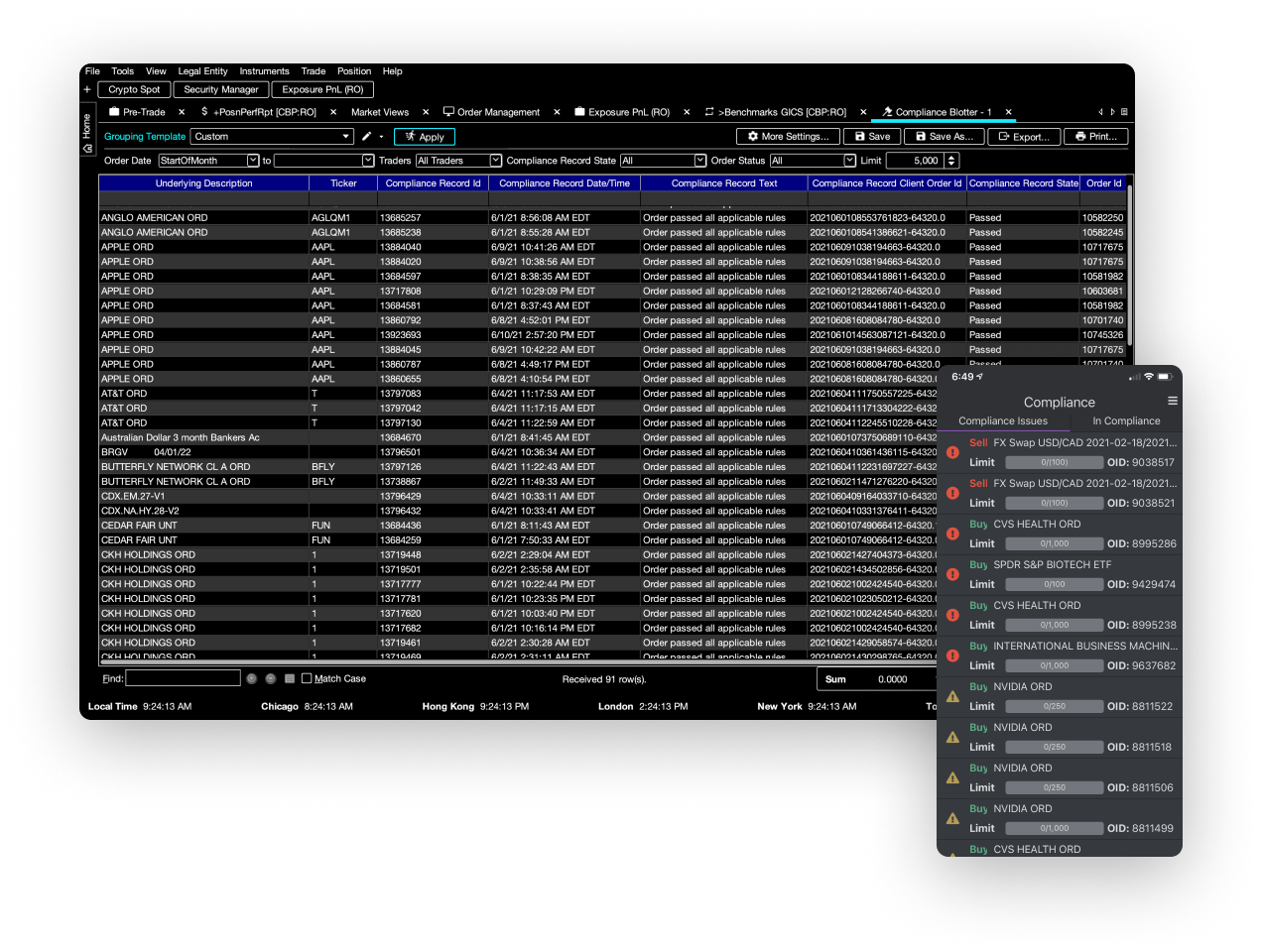

While the middle office plays a pivotal role in the investment process, it must also walk a fine line. At the order-creation stage, compliance controls need to be detailed enough to prevent missteps, yet have enough flexibility to allow those with proper authority to override certain ones under specific circumstances.

Further upstream in the process, analysts and portfolio managers need to be confident that they are looking at their portfolio’s risks through many lenses and not missing any hidden exposures. Which requires both real-time visibility into portfolio positions as well as valuations based on real-time market data.

By synchronizing the entire firm through a single, “golden” dataset, Enfusion creates the perfect environment for building out a best-of-breed risk management discipline and governance framework.

Risk, reporting, and compliance at their very best.

Challenge

How Enfusion Can Help

Challenge

Manual processes are slow and offer limited oversight.

How Enfusion Can Help

Integrated risk and compliance.

Challenge

The firm’s existing compliance system has already been fully automated.

How Enfusion Can Help

Flexible APIs.

Challenge

Compliance officers can be away from their desktop system at critical times.

How Enfusion Can Help

Web and mobile access.

Challenge

Need to scale up without increasing headcount.

How Enfusion Can Help

Process automation.

Challenge

Portfolio managers wish to enter new markets that have very different workflows.

How Enfusion Can Help

Deep multi-asset support.

Statistics

Strength in numbers.

9

OFFICES ACROSS FIVE CONTINENTS

18

YEARS OF CLOUD-NATIVE SAAS

775+

Implementations